Company Overview

At ACME Trades, we offer an educational and training platform, providing aspiring traders the skills to become consistent and profitable within the world's markets.

Our strategies, regardless of trading style, work on all timeframes and markets.

Pioneers of the ACME Algorithm

and ACME alert service

Company Overview

At ACME Trades, we offer an educational and training platform, providing aspiring traders the skills to become consistent and profitable within the world's markets.

Our strategies, regardless of trading style, work on all timeframes and markets.

Pioneers of the ACME Algorithm

and ACME alert service

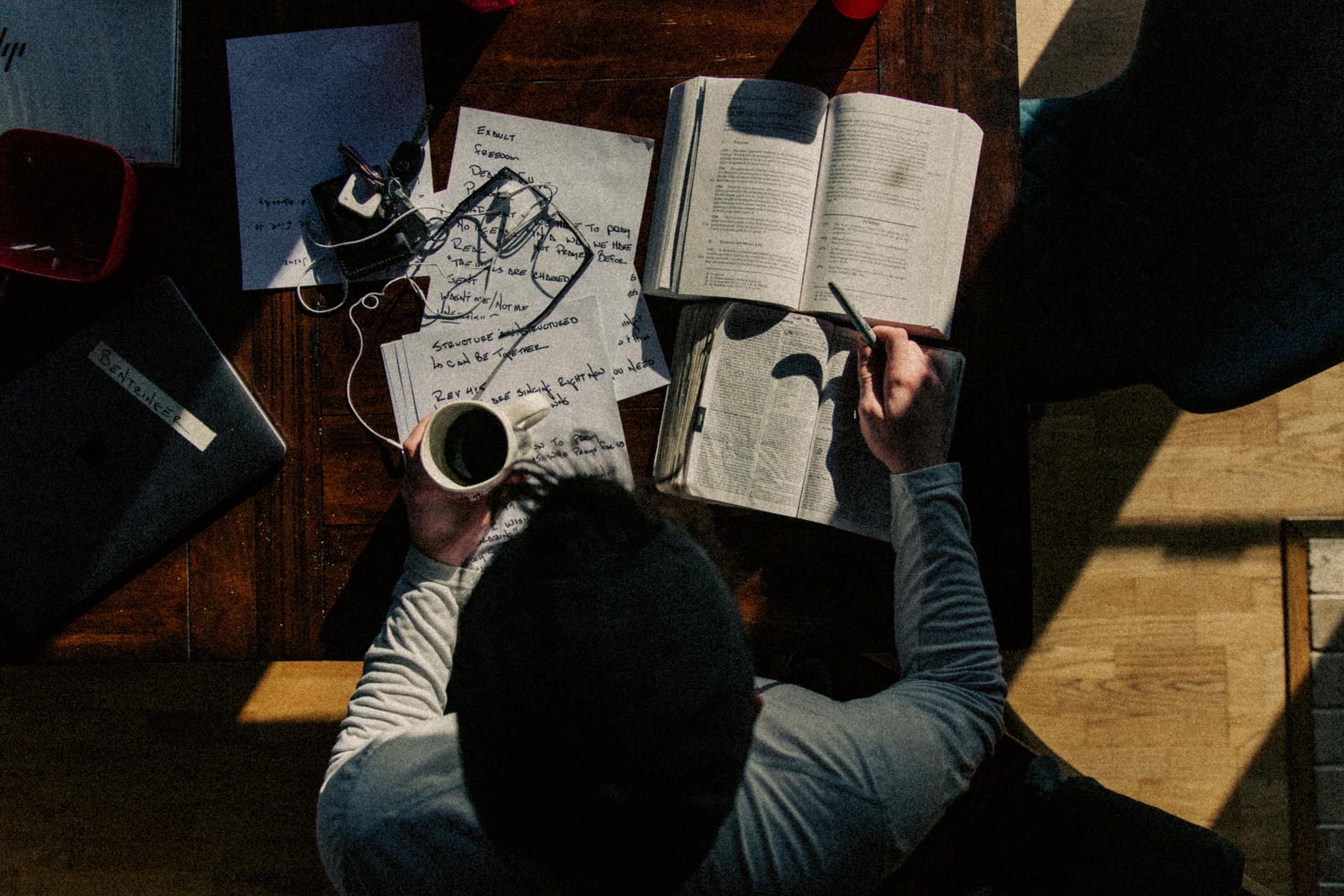

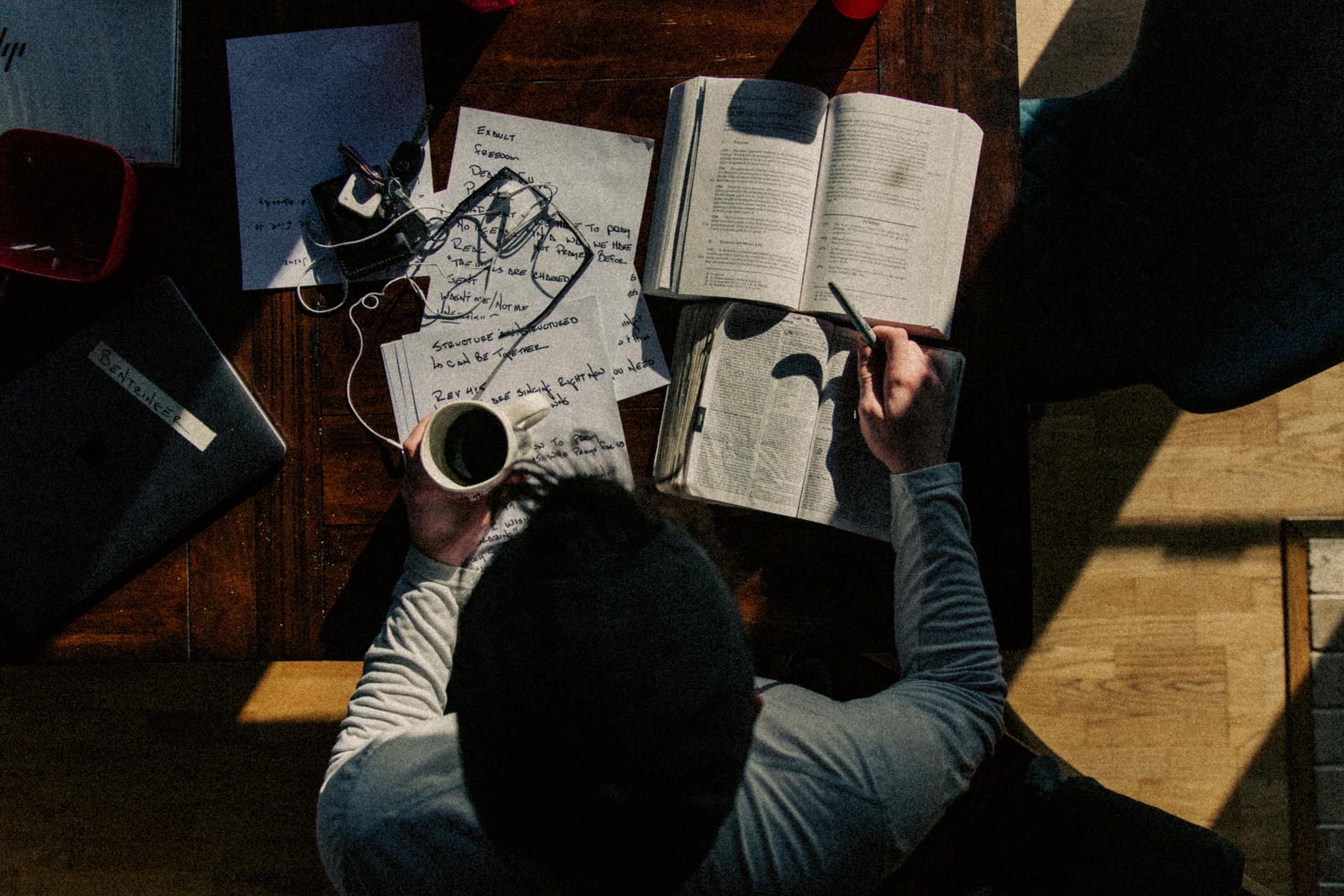

ACME Ethos

Study

Understand the language of the markets, by using our principles and concepts

Practice

Establish the correct trading habits. Discover your strengths and weaknesses

Application

Execute your trading plan and strategies. Log and journal your discoveries

Mastery

Trading at peak performance with emphasis on strategy enhancement

By following the ACME Ethos, our methodology provides the ability to read the market

bar-by-bar with ultimate precision. Using this skill we exploit the supply/demand imbalances that provide our edge

Our Team

MEET THE INSTRUCTOR

Will of ACME Trades

CEO, Chief Educator & Principal Trader at ACME Trades. Over 15 years of experience within the financial markets, Will has adopted a modern adaption of Wyckoff. Regularly hosts a webinar (EHP) for a group of international traders with the primary focus towards application of the ACME Methodology. Co-hosts a weekly webinar in collaboration with Wyckoff Analytics. All educational content has been produced and presented by Will.

In addition, Will was a guest speaker at The Best of Wyckoff Conferences 2021, 2022 & 2023. Written articles for the Society of Technical Analysis (STA) and other online publications. Developed the ACME algorithm and the ACME alert service.

TECH & SUPPORT

Benjamin Martinsen

Ben is responsible for the ACME experience; from technical support to customer relations and manages the ACME Trades social media presence. Combining his passion and in-depth knowledge of our methodology, Ben has coded various algorithms along with software that provides a unique trading solution – EHP interactive element & the ACME alert service.

ACME Ethos

Study

Understand the language of the markets,

by using our principles and concepts

Practice

Establish the correct trading habits.

Discover your strengths and weaknesses

Application

Execute your trading plan and strategies.

Log and journal your discoveries

Mastery

Trading at peak performance with emphasis

on strategy enhancement

By following the ACME Ethos, our methodology provides the ability to read the market

bar-by-bar with ultimate precision. Using this skill we exploit the supply/demand imbalances that provide our edge

Our Team

MEET THE INSTRUCTOR

Will of ACME Trades

CEO, Chief Educator & Principal Trader at ACME Trades. Over 15 years of experience within the financial markets, Will has adopted a modern adaption of Wyckoff. Regularly hosts a webinar (EHP) for a group of international traders with the primary focus towards application of the ACME Methodology. Co-hosts a weekly webinar in collaboration with Wyckoff Analytics.

All educational content has been produced and presented by Will. In addition, Will was a guest speaker at The Best of Wyckoff Conferences 2021, 2022 & 2023. Written articles for the Society of Technical Analysis (STA) and other online publications. Developed the ACME algorithm and the ACME alert service.

TECH & SUPPORT

Benjamin Martinsen

Ben is responsible for the ACME experience; from technical support to customer relations and manages the ACME Trades social media presence. Combining his passion and in-depth knowledge of our methodology, Ben has coded various algorithms along with software that provides a unique trading solution – EHP interactive element & the ACME alert service.

Methodology & Integration

WYCKOFF >>

Inspired by the principles and concepts established by Wyckoff. The methodology primarily uses the 3 laws: The Law of Supply and Demand, Cause and Effect and Effort vs. Result. By using these tools, we can determine the background to be of either strength or weakness.

VSA >>

A branch of Wyckoff evolved into Volume Spread Analysis (VSA) founded by Tom Williams. The core of VSA is based upon the integral relationship between price, volume and the spread of the bar. Understanding this interaction provides the trader with the ability to read the market bar-by-bar.

ACME

Combining the works of Wyckoff, VSA and price action, ACME provides the process towards mastery of application, offering a modern interpretation of Wyckoff. This empowers the trader with precision, resulting with an increased edge throughout the trading process.